When it comes to financial statements, each communicates specific information and is needed in different contexts to understand a company’s financial health.

The income statement is an essential financial document that details your company's income and expenses over a specific period. This document communicates a wealth of information to those reading it—from key executives and stakeholders to investors and employees. Being able to read an income statement is important, but knowing how to generate one is just as critical.

Here’s an overview of the information found in an income statement, along with a step-by-step look at the process of preparing one for your organization.

Free E-Book: A Manager's Guide to Finance & Accounting

Access your free e-book today.

An income statement is a financial report detailing a company’s income and expenses over a reporting period. It can also be referred to as a profit and loss (P&L) statement and is typically prepared quarterly or annually.

Understanding income statements is vital because they depict a company’s financial performance over a reporting period. Because the income statement details revenues and expenses, it provides a glimpse into which business activities brought in revenue and which cost the organization money—information investors can use to understand its health and executives can use to find areas for improvement.

An income statement typically includes the following information:

Your reporting period is the specific timeframe the income statement covers. Choosing the correct one is critical.

Monthly, quarterly, and annual reporting periods are all common. Which reporting period is right for you depends on your goals. A monthly report, for example, details a shorter period, making it easier to apply tactical adjustments that affect the next month’s business activities. A quarterly or annual report, on the other hand, provides analysis from a higher level, which can help identify trends over the long term.

After identifying your reporting period, calculate your business's total revenue generated in that timeframe.

If you prepare the income statement for your entire organization, this should include revenue from all lines of business. If you prepare the income statement for a particular business line or segment, you should limit revenue to products or services that fall under that umbrella.

Next, calculate the total cost of goods sold for any product or service that generated revenue for your business during the reporting period. This encompasses direct and indirect costs of producing and selling products or services, including:

The next step is to determine gross profit for the reporting period. To calculate this, simply subtract the cost of goods sold from revenue.

Once you know gross profit, calculate operating expenses (OPEX).

Operating expenses are indirect costs associated with doing business. These differ from the cost of goods sold because they’re not directly associated with the process of producing or distributing products or services. Examples of expenses that fall under the OPEX category include:

To calculate total income, subtract operating expenses from gross profit. This number is essentially the pre-tax income your business generated during the reporting period. This can also be referred to as earnings before interest and taxes (EBIT).

After calculating income for the reporting period, determine interest and tax charges.

Interest refers to any charges your company must pay on the debt it owes. To calculate interest charges, you must first understand how much money you owe and the interest rate being charged. Accounting software often automatically calculates interest charges for the reporting period.

Next, calculate your total tax burden for the reporting period. This includes local, state, and federal taxes, as well as any payroll taxes.

The final step is to calculate net income for the reporting period. To do this, subtract interest and then taxes from your EBIT. The number remaining reflects your business’s available funds, which can be used for various purposes, such as being added to a reserve, distributed to shareholders, utilized for research and development, or to fuel business expansion.

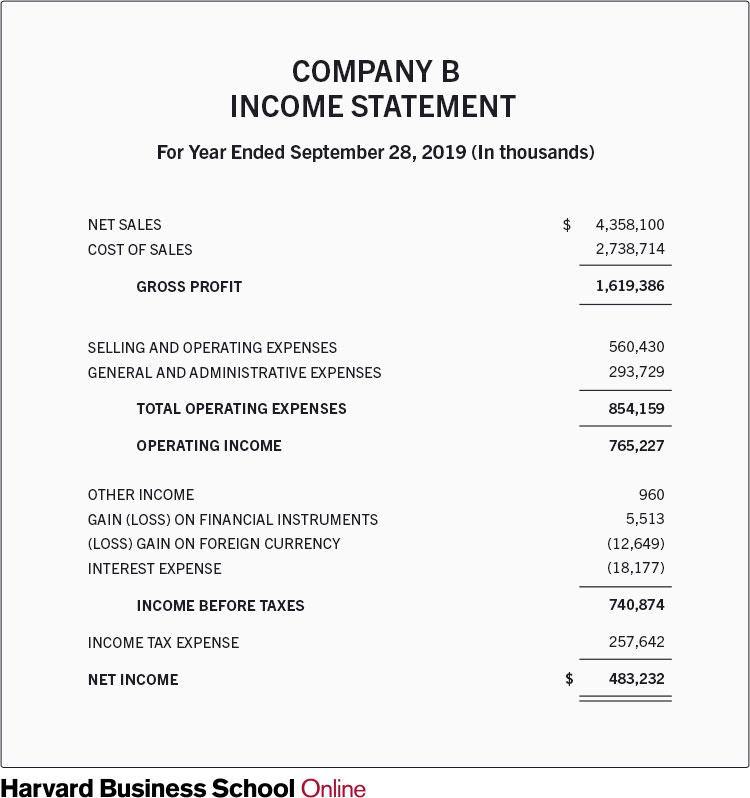

Below is an example income statement for a fictional company. As you can see at the top, the reporting period is for the year that ended on Sept. 28, 2019.

During the reporting period, the company made approximately $4.4 billion in total sales. It cost the business approximately $2.7 billion to achieve those sales. As a result, gross profit was about $1.6 billion.

Next, $560.4 million in selling and operating expenses and $293.7 million in general administrative expenses were subtracted. This left the company with an operating income of $765.2 million. To this, additional gains were added and losses subtracted, including $257.6 million in income tax.

At the bottom of the income statement, it’s clear the business realized a net income of $483.2 million during the reporting period.

As you start preparing income statements, here are three factors to consider to make the process easier and ensure accuracy.

Precise financial records require proper categorization of expenses and revenues. Errors often arise from misclassifications and omissions of one-time gains. Utilize accounting software and a detailed checklist to ensure accurate entries and comprehensive income tracking.

Correctly recording prepaid expenses and depreciation is crucial. They should reflect the actual periods they apply to. This can be facilitated by advanced accounting software, which automates and minimizes errors in entries.

Automating data entry processes and conducting regular audits can help reduce manual data entry errors like duplication and omissions. It's important to do monthly account reconciliations to maintain data integrity and ensure financial records are accurate and follow the rules.

Although the income statement is typically generated by a member of the accounting department at large organizations, knowing how to compile one is beneficial to a range of professionals.

Whether you’re an individual contributor, a member of the leadership team in a non-accounting role, or an entrepreneur who wears many hats, learning how to create an income statement can provide a deeper understanding of the financial metrics that matter to your business. It can also help improve your financial analysis capabilities.

Do you want to take your career to the next level? Consider enrolling in Financial Accounting—one of three courses comprising our Credential of Readiness (CORe) program—which can teach you the key financial topics you need to understand business performance and potential. Not sure which course is right for you? Download our free flowchart.

This post was updated on September 4, 2024. It was originally published on December 9, 2021.

For Year Ended September 28, 2019 (In thousands)

| Activity | Amount |

|---|---|

| Net Sales | 4,358,100 |

| Cost of Sales | 2,738,714 |

| Gross Profit | 1,619,386 |

| Selling and Operating Expenses | 560,430 |

| General and Administrative Expenses | 293,729 |

| Total Operating Expenses | 854,159 |

| Operating Income | 765,227 |

| Other Income | 960 |

| Gain (Loss) on Financial Instruments | 5,513 |

| (Loss) Gain on Foreign Currency | (12,649) |

| Interest Expense | (18,177) |

| Income Before Taxes | 740,874 |

| Income Tax Expense | 257,642 |

| Net Income | 483,232 |